- Knowledge is power

- The Future Of Possible

- Hibs and Ross County fans on final

- Tip of the day: That man again

- Hibs and Ross County fans on final

- Spieth in danger of missing cut

Huawei delivered the Pura 70 line of cell phones in April 2024 and it’s now made somewhat of a mix. Last year, another Huawei cell phone, the Mate 60, shocked the world with a high level 7nm-process Framework on Chip — regardless of US authorizes that restricted Chinese admittance to the most recent lithography machines. Of course, it was still a long time behind other semiconductor makers, which had continued on toward 3nm-process chips. Yet, they made up for lost time quicker than generally anticipated.

As the tech world guessed this new cell phone, everybody needed to be aware: Has China kept on propelling its semiconductor producing processes, in resistance of approvals? Is the chip in the Pura 70 new? Better? Where is it made, and on what hardware?

To find a few solutions, we destroyed the Pura 70 Ace in a joint effort with our accomplices at TechSearch Worldwide.

A More intensive Glance at the Kirin 9010

Because of those equivalent authorizations, we were unable to get a Pura 70 in our US office. In any case, we got some assistance from Reuters, who worked with our group in Shenzhen to do a 12 PM teardown and draw a nearer take a gander at the telephone’s new silicon — which is, we found, the new Kirin 9010 Framework on Chip.

In the same way as other present day SoC bundles, the Kirin 9010 processor sits under the Measure module, the 12GB SK Hynix chip in this occurrence. Eliminating the chip uncovers the processor.

From this picture, one detail stuck out. The outer markings appeared to match the more established Kirin 9000S which was delivered on SMIC’s 7nm hub, ordinarily alluded to as N+2. We showed this to one of our industry specialists, and they noticed that the chip identifiers specifically were uncommon in that another chip typically has its own model number. Not for this situation: the 9000S (model HI36A0 update GFCV120) and the 9010 (model HI36A0 modification GFCV121) share a similar model number.

In the days that followed, we saw comparable feelings seem on the web. TechInsights recommended that the Kirin 9010 seemed, by all accounts, to be on a similar N+2 process hub. The predominant hypothesis is that the Kirin 9010 is, at its heart, a 9000S with a modified plan pointed toward further developing creation yields. The enhancements may not be restricted to creation however — early benchmarks recommend that the 9010 likewise plays out somewhat better compared to the 9000S.

This is huge in light of the fact that insight about the 9000S on a 7nm hub caused somewhat of a frenzy last year when US legislators were defied with the likelihood that the authorizations forced on Chinese chip creators probably won’t slow their mechanical advancement all things considered. The way that the 9010 is as yet a 7nm cycle chip, and that it’s so near the 9000S, could definitely imply that Chinese chip producing has without a doubt been eased back. Be that as it may, don’t underrate Huawei. SMIC (Semiconductor Assembling Worldwide Company) is as yet expected to take the jump toward a N5 comparable hub before the year’s end, while possibly not presently. They as of now have the innovation and expertise; it’s just a question of accomplishing industrially practical yields.

In any case, doubtlessly that the Chinese semiconductor industry is following quite a long while behind TSMC, Worldwide Foundries, Samsung, and other Western-adjusted fabs with admittance to ASML’s EUV (Outrageous Bright) photolithography machines. SMIC couldn’t advance to the 5nm hub process since the arrival of the 9000S while TSMC has a N2 hub in its sights — a generational contrast of 3 hubs addressing six years of cycle refinement. That ought to put the specialized difficulties confronting China’s semiconductor industry into viewpoint.

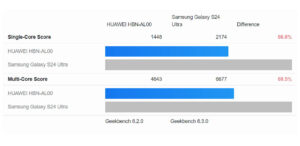

Taking a gander at the benchmarks between the 9000S, 9010, and 2023’s Qualcomm Snapdragon 8 Gen 3 delivered by TSMC shows how far Chinese semiconductor producing has come, yet additionally the way in which far they need to go. The Kirin 9010 performs amazingly more terrible than TSMC’s N4P determined Snapdragon 8 Gen3. N4P is a hub cycle got from the N5 hub and declared by TSMC back in 2021 and its N5 parent hub is just a solitary age separated from the N7 hub of the Kirin 9000S and 9010. In the mean time, the exhibition increment between the 9000S and 9010 remaining parts in single digits. This new SoC is imperceptibly better yet not the tremendous jump that was normal.

To accomplish those single-digit execution builds, the Kirin 9010’s 12-center SoC utilizes six ARM Cortex A510 productivity centers running at 1550 MHz matched with four Taishan v121 centers running at 2180 MHz and two Taishan v121 centers running at 2300 MHz.

By examination, the 9000S is accounted for to have a 8-center SoC (confusingly there are bunches of benchmarks that report 12 centers since a new HarmonyOS update however this is impossible) containing four ARM Cortex A510’s running at 1530 MHz matched with three Taishan centers running at 2150 MHz and one Taishan v120 center running at 2620 MHz.

The Taishan centers are custom ARM Cortex processors and the form numbers give some understanding into the update number imprinted on the chip. The A510 itself is an ARM Cortex processor from 2020, since supplanted by the A520.

Made in China… Generally

It’s remarkable to see that the Huawei Pura 70 is near turning into China’s perfect example for independence. Most of the chips we found are planned and produced in China with two or three remarkable special cases.

SK Hynix was outstandingly present, regardless of asserting that they had not offered anything to Huawei since sanctions kicked in back in 2020. It’s entirely conceivable that these chips are the remainder of a diminishing supply of SK Hynix Ic’s.

The other large name presence on the PCB was Bosch, with their 6-hub whirligig and accelerometer MEMS sensor. As a worldwide innovator in the stock and plan of MEMS sensors, Bosch’s presence wouldn’t cause a stir were it not for the way that Chinese makers most likely can create these sensors locally.

You can track down our full chip ID on our site.

NAND Streak Memory

However, maybe the most fascinating IC inside the Pura 70 Ace is HiSilicon’s 1TB NAND streak memory. It’s actually significant that the European business sectors can get the 256GB and 512GB NAND modules.

Looking Past 5nm

For the time being, the US has effectively limited China’s capacity to efficiently manufacture on the 7nm hub at significant returns. Likewise, it has additionally kept China from efficiently manufacturing on a N5 comparable hub at exceptional returns. But this has not kept China from advancing in different regions, prominently as a market chief and trend-setter in 3D NAND innovation.

The greatest test as of now confronting the Chinese semiconductor area is their failure to get to the most recent hub processes. The EUV photolithography machines that empower prudent and versatile creation of N3 hubs and past are only made and sold by a solitary organization in the Netherlands: ASML. While US sanctions stay basically, Chinese fabricators will be compelled to manage lower yields and greater expenses for more seasoned tech while at the same time spending truckloads of cash on Research and development to create their own EUV and DUV photolithography frameworks.

Regardless of these difficulties, China is supposed to take the jump from a 7nm hub cycle to 5nm quickly, however creation yields are probably going to stay low. In the interim, CXMT (ChangXin Memory Advancements) is anticipated to supplant SK Hynix as pre-sanctions loads of LPDDR5 decrease.

We hope to see a 5nm hub from these fabs. The inquiry is, where will they go from that point? Have confidence, we’ll keep our eyes — and our screwdrivers — on Huawei.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.